|

|

There was an issue with your input |

Personal Trust

Perhaps nothing requires more strategic and careful planning than providing for loved ones. That's why planning for a family's financial future should be a natural part of the overall investment planning process.

Benefits of Personal Trust

- Full suite of Fidelity services to meet any client need

- Maintain control over your client's investable assets

- Serve more investors over multiple generations

About Personal Trust

Personal Trust is part of Fidelity's holistic planning value proposition, and is attractive to new and existing clients, with the ability to maintain assets over multiple generations.

Our services are designed to help you

- Manage money today and through generational wealth transfer

- Gain referrals

- Drive deeper engagement with the unengaged spouse and next generation

- Tap into increased asset consolidation opportunities

- Increase household retention

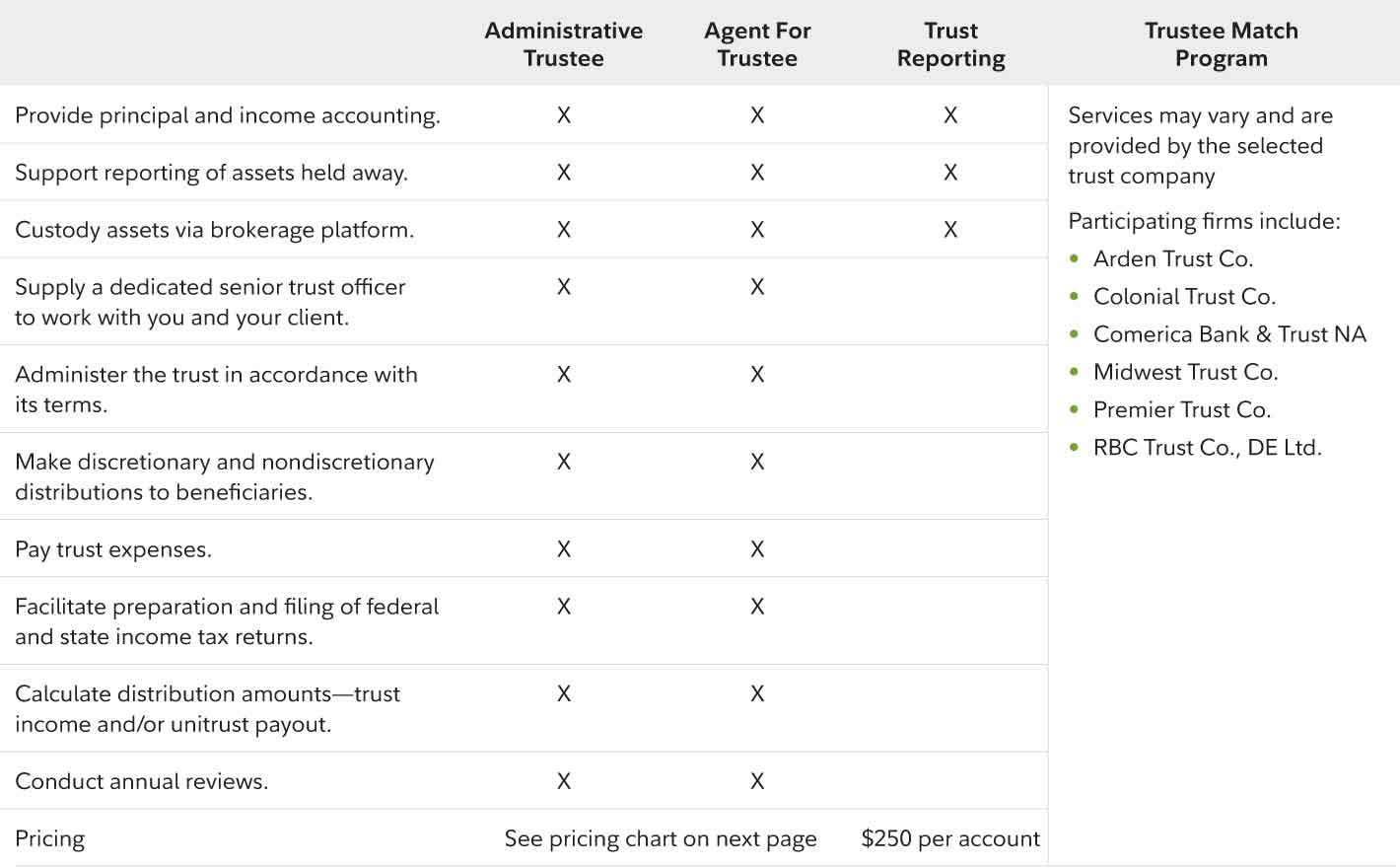

Administrative Trustee Service

Personal Trust is appointed to be corporate trustee.

Managing trust administration and client relationships can be challenging.

With Fidelity as corporate trustee, you may have more time to build a better relationship with your client:

Agent for Trustee Service1

Trustee needs assistance with trust administration duties and appoints Personal Trust to act as agent.

Added duties of trust administration leaves less time to manage trust assets.

Fidelity works on your behalf to make sure all aspects of the trust are being adhered to:

Trust Reporting Service1

Investor/trustee needs principal and income and/or assets held away included on statements and online portals along with a net income payment feature.

Fidelity's Trust Reporting is quick and simple to set up, with easy access to wealth management for your clients:

Trustee Match Program2

Network of trust companies available to act as corparate trustee

Related resources

Additional resources

- Non-deposit investment products offered through Fidelity Personal Trust Company and other affiliates of Fidelity Investments are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, are not obligations of any bank, and are subject to risk, including possible loss of principal. For Investment Professional use only. Not for distribution the public as sales material in any form. Third party marks are the property of their respective owners; all other marks are the property of FMR LLC.