A gameplan for market corrections

It pays to keep perspective in a market downturn.

- Market corrections have historically been a normal part of investing.

- While it's natural for investors to fear the worst, historically the US market and economy have always recovered from even the steepest pullbacks.

- Given the inevitability of market pullbacks, it's important for investors to have a plan they can stick with through ups and downs.

After setting new all-time highs in February, the S&P 500® Index of large-cap US stocks has fallen by more than 10%. While not an official definition, a drop of 10% from market highs is generally considered a correction.

The sell-off seems to be driven by concerns around global economic growth. Recent weeks have seen declines in consumer confidence and estimated first-quarter economic growth, plus an uptick in layoffs by US employers.

“After 2 strong years of stock market returns, this recent bout of market volatility may feel particularly jarring for investors,” says Naveen Malwal, institutional portfolio manager with Strategic Advisers, LLC, the investment manager for many of Fidelity's managed accounts. “And given some of the fast-moving news headlines over the last few weeks, I can appreciate why some investors may feel anxious.”

With a correction at hand, it may be time to brush up on what corrections have typically looked like, and what investors may want to consider.

How unusual is a decline of this magnitude?

While corrections can be unnerving, they have historically been a normal part of investing.

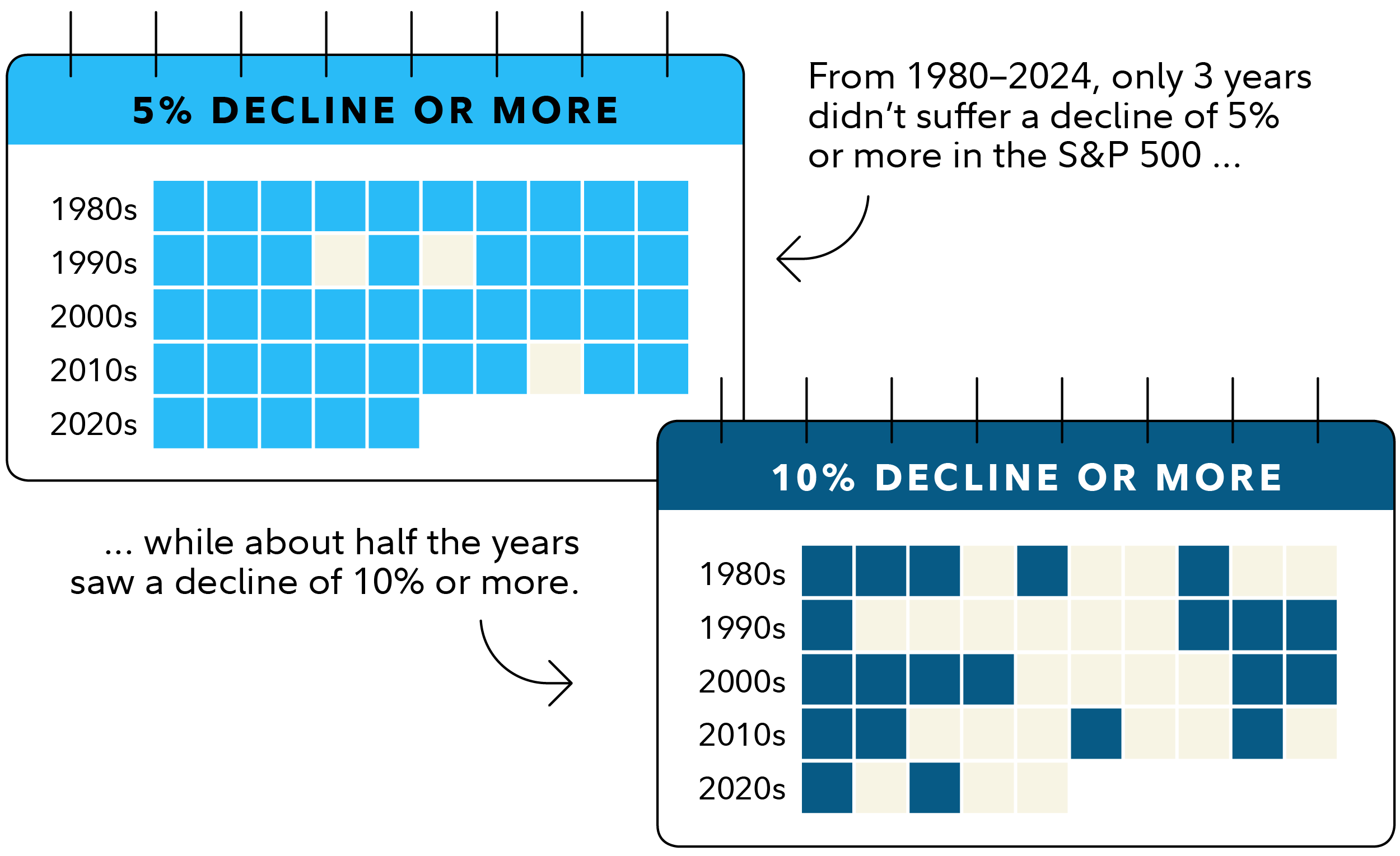

Since 1980, the S&P 500 has experienced a drop of 5% or more in 93% of calendar years, and has experienced a drop of 10% or more in 43% of calendar years.

Past performance is no guarantee of future results. Biggest drop refers to the largest drop from a peak to a trough in the S&P 500 during each calendar year. Data as of December 31, 2024. Sources: Standard & Poor's, Bloomberg Finance L.P., Fidelity Investments.

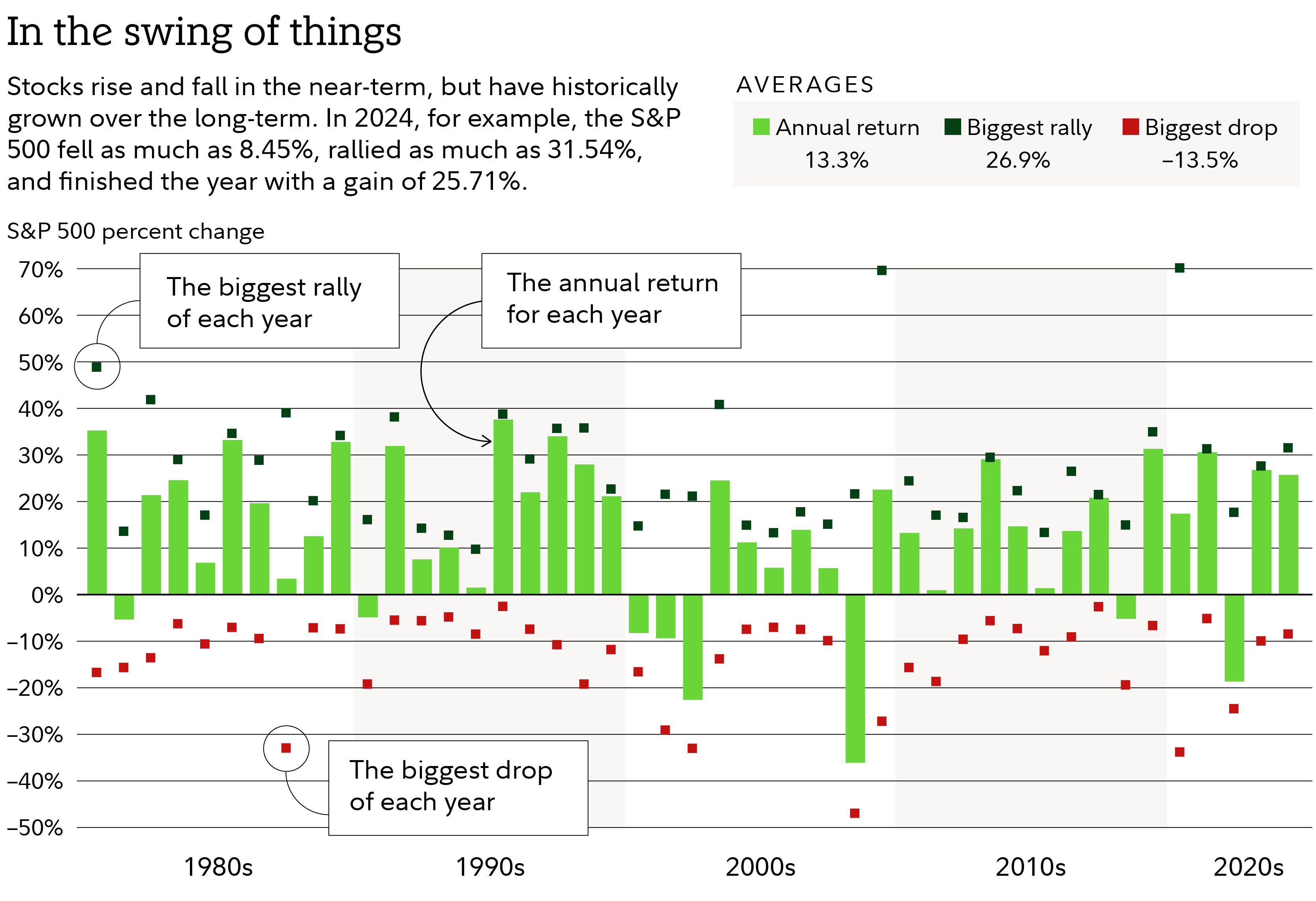

Despite those frequent declines, the market's average calendar-year return over the same period has been 13.3%.

How long and deep will this correction be?

It's impossible to say how long it may take for stocks to recover their previous highs and for volatility to subside, due to the complexity of the economic factors at work and the inherent unpredictability of future events.

But historically, the market has typically recovered quickly from corrections. The chart below shows the largest drop from a market high in each year (red dots). It's not uncommon to experience significant market declines. But the market still has often recovered and produced positive results in most years (shown as the green bars).

Past performance is no guarantee of future results. Returns are based on index price appreciation and dividends. Indexes are unmanaged. It is not possible to invest directly in an index. Biggest drop refers to the largest index drop from a peak to a trough during each calendar year. Biggest rally refers to the largest index gain from a trough to a peak during each calendar year. Data as of December 31, 2024. Sources: Standard & Poor’s, Bloomberg Finance L.P., Fidelity Investments.

“Since 1980, the S&P 500 index has experienced a decline of about -14% on average in any given calendar year,” says Malwal. “Yet stocks have normally recovered and finished with average gains of about 13% in any given calendar year, including dividends. So a market decline of -10 or -15% isn't unusual, nor necessarily a sign that stocks will continue to decline. Market volatility can feel unsettling, but it is normal.”

Is this time different?

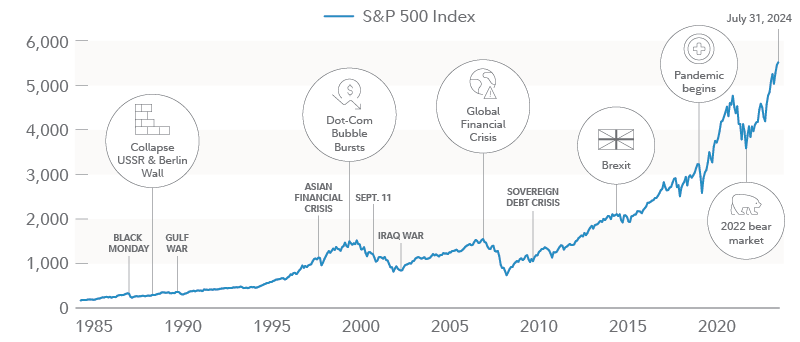

Some investors may nevertheless be worried that “this time is different.” In the midst of uncertainty, it's natural to fear the worst. Yet investors should remember that historically the US economy and stock market have again and again surmounted steep obstacles—including pandemics, recessions, market bubbles, and even a depression—and eventually gone on to thrive.

Past performance is no guarantee of future results. Source: FMRCo, Bloomberg, Haver Analytics, FactSet. Data as of July 31, 2024. The S&P 500® Index is a market capitalization–weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation. S&P and S&P 500 are registered service marks of Standard & Poor's Financial Services LLC. The CBOE Dow Jones Volatility Index is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. You cannot invest directly in an index.

“It may also help to remember that markets can react to news headlines and emotions in the short-term,” says Malwal. “But over the long run, stocks have usually risen if corporate profits are growing. Corporate profits rose about 14% during the fourth quarter of last year and are expected to experience double-digit growth in 2025, based on analysts' estimates.”

What it means for investors

While it can take nerves of steel not to react when stocks are falling, this has often been the best course of action. Investors who sell, in an attempt to head-off further losses, risk locking in potential losses and often miss out on the market's subsequent recovery. Here's how to think about investors' potential best course of action.

Long-term investors: Stick with your plan

If an investor is saving for retirement or another goal that is years away, the time to consider how much of a loss they can handle isn't during a correction. Rather, the investor should consider the appropriate risk level for their portfolio when they are looking at their long-term goals, and thinking clearly about their financial situation and emotional reaction to risk.

If an investor hasn't created a plan, it is recommended that they should. If an investor does have a plan, it may be worth checking in to see if their investments are still in line with that plan and if the plan continues to reflect their investment horizon, financial situation, and risk tolerance. If all that is so, an investor will likely be in a better position to manage the ups and downs of the market. If an investor's mix of investments is off track, consider rebalancing back to a more neutral positioning.

Retirees: Manage income

For retirees, who may be relying on their investment portfolio for a portion of their income, a market drop can present a different kind of challenge. If an investor has an income plan that is built to withstand different market conditions, they really don't need to react to a short-term market move. If not, it may be a good time to sit down with a financial professional to discuss their strategy.

The bottom line

While we don't know if any pullback will be short-lived or the beginning of a bigger downturn, history shows that the stock market recovers from downturns, and most sound investment strategies are built to withstand volatility, even sharp pullbacks.

Next steps to consider

Asset Allocation Research Team (AART)

Access economic, fundamental, and quantitative analysis from our Asset Allocation Research Team.

Learn more

Investment & Retirement Products

Meet the unique financial needs of your clients with our diverse investment and retirement offerings.

Learn more

Money Market Funds Resource Center

Browse through powerful insights and resources from one of the largest money market mutual fund providers in the industry.

Learn more

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Investing involves risk, including risk of loss.

Past performance and dividend rates are historical and do not guarantee future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

The S&P 500® Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance.

Indexes are unmanaged. It is not possible to invest directly in an index.

Strategic Advisers LLC (Strategic Advisers) is a registered investment adviser and a Fidelity Investments company.

Fidelity Investments® provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC; and institutional advisory services through Fidelity Institutional Wealth Adviser LLC.