Government shutdowns and investors

History suggests little impact on markets and the economy.

- Some of the federal government’s activities are shut down until Congress can agree to fund them.

- Historically, the impact of government shutdowns on financial markets has been limited and short-lived.

- A prolonged government shutdown could slow economic growth but is not likely to trigger a recession.

- Investors should not overreact to news events and instead should stay focused on their long-term investing strategies.

After much congressional wrangling that failed to produce a federal funding bill, a government shutdown is upon us. That means non essential federal government activities will close temporarily, though essential services including Social Security and the air traffic control system will continue as usual.

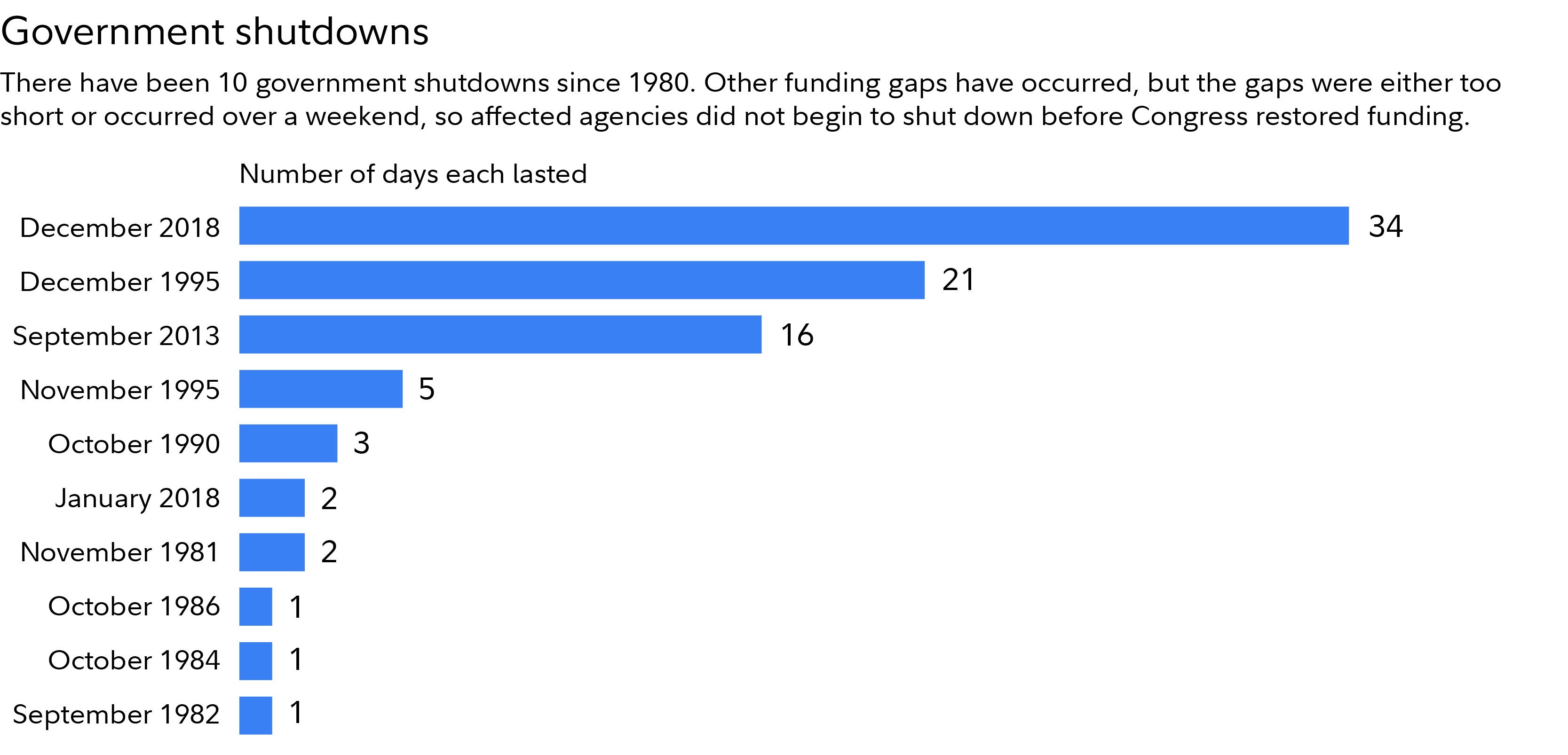

Shutdowns are hardly a rarity. Since the first in 1981, the government has been forced to shut down 11 times. The lengths have ranged from 1 day to 34 in 2018. But even when shutdowns have been extended, there has been little adverse impact on the economy, markets, or most anyone outside the Washington beltway.

While the shutdown may spark some short-term market volatility, Fidelity experts caution investors against making major shifts to their financial plans based on these kinds of events. “It's important to have a long-term plan and to not make emotional decisions. If your portfolio is overly affected by these types of headlines, maybe that's an opportunity to make sure that you actually have the portfolio that you should be in,” says Global Macro Strategist Jurrien Timmer.

Source: US House of Representatives

How might a government shutdown affect stocks this time?

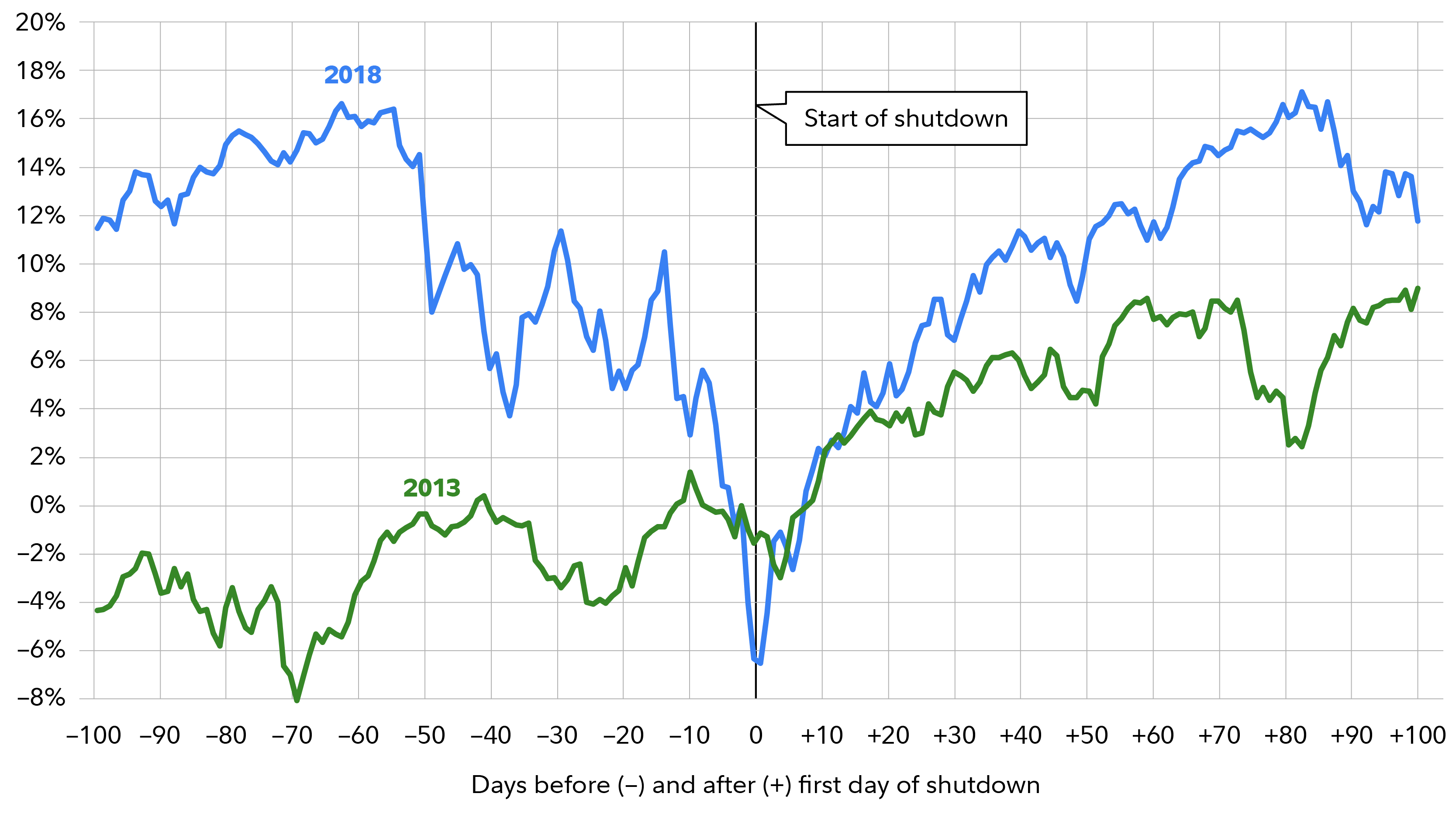

If there’s anything positive about this pattern of recurring shutdowns, it may be that it’s now gone on long enough to show that past shutdowns have had little impact on investors, consumers, or financial markets. “Even longer shutdowns such as the ones that took place in 2013 and 2018, which were disruptive and costly, did not move the stock market,” says Timmer.

Timmer’s belief that shutdowns are not significant events for stocks is based on analyzing historical data about the performance of the S&P 500 during the 100 days before and after the 2 longest shutdowns. In both cases, stocks rose strongly in the 100 days following the shutdowns of nonessential government services.

Timmer also points out that the 2018 shutdown took place when stocks were nearing the tail end of what he calls an “unrelated 20% drawdown” and began a strong rally while the government was still on hiatus. So far this year, by comparison, stocks have followed a similar path, with a double-digit drop in April followed by a robust rally.

What this history shows is that market participants understand that short-lived political drama makes headlines but does not have a meaningful impact on corporate earnings, which are the primary drivers of stock prices. That's especially true for news events such as a shutdown where the eventual outcome is predictable. As Timmer puts it, "We've all seen this movie before and it always ends the same way."

S&P 500 performance around 2013 and 2018 shutdowns

Sources: FMR, Bloomberg

How might a government shutdown affect fixed income this time?

Unlike a government debt crisis where a default is possible, a brief shutdown of government agencies poses little risk to fixed income investments. The Treasury will conduct its regularly scheduled bond auctions and continue to pay interest on its debt regardless of whether other government agencies are open or closed. Government money market funds are also unaffected by the shutdown.

Some short-lived volatility in the Treasury market could be possible if some investors choose to express displeasure with US fiscal policy by selling Treasurys as they did in April in response to the announcement of new US tariffs.

A prolonged shutdown could also potentially affect prices of some bonds issued by corporations who rely on contracts with the federal government for a significant portion of their revenues.

How might a government shutdown affect the US's credit rating?

Perhaps the most significant longer-term impact of a shutdown for investors and consumers alike could stem from how credit rating agencies react to the continuing turmoil in Washington. While markets may look past shutdowns, these firms who take a longer-term view of the government's fiscal well-being appear less willing to do so. Ratings agency Moody's has already downgraded the federal government's credit earlier this year, and further downgrades by all 3 ratings agencies are possible. That could raise borrowing costs for the government, potentially push up interest rates, and increase volatility in financial markets, perhaps long after any shutdown has ended.

Will a government shutdown affect the economy?

While history shows that government shutdowns have had little long-term effect on stock prices—or on the size and functioning of the federal government—they do have a potential economic impact if they drag on.

The federal government spends enormous amounts of money buying goods, providing services, and otherwise generating economic activity. A lengthy shutdown of even some of those activities could lower US economic activity by a measurable amount.

Fidelity's Asset Allocation Research Team believes a government shutdown could be a small drag on the economy but not a devastating blow that would create a recession by itself. However, the longer a shutdown persists the greater the damage would be.

In addition to the obvious direct impact of hundreds of thousands of government workers and contractors not getting paid, the uncertainty around an open-ended shutdown threatens business and consumer confidence. If companies and consumers don't know when government services will be up and running, it becomes more difficult to make investment or spending plans.

How will a shutdown affect government services?

A shutdown would cause an interruption of some government services but not all. Social Security, Medicaid, and Medicare payments to recipients would not be affected. Neither would what are called essential services such as federal law enforcement, air traffic control, and disaster relief. The US Post Office would also not be affected.

Should investors worry about their investments when a government shutdown happens?

While the shutdown is generating worrisome headlines, the only thing most people have to fear is the temptation to overreact to those headlines and make personal financial decisions based on fear and uncertainty. If investors already have an investment strategy built around their goals, financial situation, timeline, and risk tolerance, they likely don't need to make any changes in response to headlines.

Next steps to consider

Investment & Retirement Products

Meet the unique financial needs of your clients with our diverse investment and retirement offerings.

Learn more

Asset Allocation Research Team (AART)

Access economic, fundamental, and quantitative analysis from our Asset Allocation Research Team.

Learn more

Advanced Modeling & Rebalancing

Take your portfolio strategies to the next level with our flexible, innovative portfolio construction and management tool.

Learn more

Related insights

View all

All indexes are unmanaged, and performance of the indexes includes reinvestment of dividends and interest income, unless otherwise noted. Indexes are not illustrative of any particular investment, and it is not possible to invest directly in an index. The S&P 500® Index is a market capitalization–weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. S&P and S&P 500 are registered service marks of Standard & Poor's Financial Services LLC.