Trump tariffs and investors

What they may mean for inflation, stocks, and the economy.

- Trade policy and tariff announcements in the US and globally may mean continued market fluctuations.

- The long-term outlook for US stocks remains positive and intermediate-term bonds can offer yield as well as diversification.

- Investors should focus on their overall strategy rather than short-term market volatility and make sure they have a diversified, long-term investment plan they can stick with.

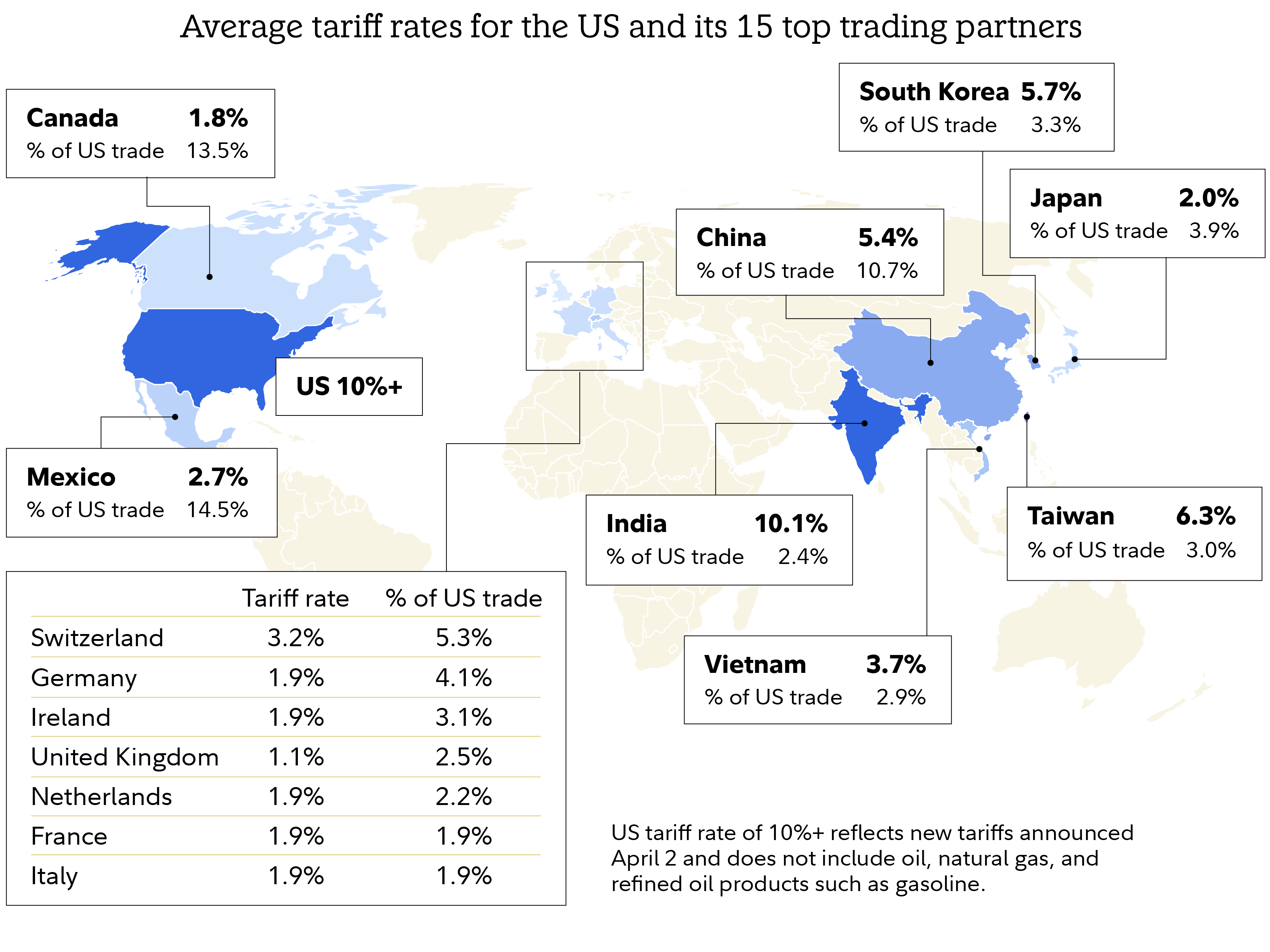

The US has announced new tariffs on imports from most of the world’s countries. These tariffs follow earlier ones on imports from Mexico, Canada, and China, as well as on imported cars, steel, and aluminum. They do not include oil, natural gas, and refined oil products such as gasoline. Many other countries also use tariffs to protect their domestic industries. The new US tariffs will particularly impact countries that are big exporters to the US and place tariffs on imports from the US.

Sources: Top US trading partners, January 2025, US Census Bureau; average tariff for nations excluding Taiwan, World Bank Group (World Bank staff estimates using the World Integrated Trade Solution system, based on data from United Nations Conference on Trade and Development's Trade Analysis and Information System database; Taiwan overall average nominal tariff rate for imported goods, International Trade Administration.

Many details about the new tariffs are still unclear so it’s uncertain how this will impact economic globalization which has been one of the drivers of the strong performance of US stocks over the past several decades. It has also helped keep inflation low even as the US economy has continued to grow.

Lars Schuster, institutional portfolio manager with Fidelity’s Strategic Advisers, says that the biggest unknown may be how long the tariffs remain in place. He says there are also other key questions in the short term: “How will companies respond? How much will they pass on to higher costs? Will they cut jobs to offset potentially higher input costs? And how will consumers respond? Will they cut spending, increase savings, substitute domestic products for imports?"

Schuster says the market is also watching to see how foreign governments may respond. “We'll be closely following all developments by tapping into our deep network of research. We will adjust portfolios as needed, including rebalancing,” he says.

Tariffs and the economy

The US imports about $4 trillion in goods and services annually. The tariffs will hit about $600 billion of them. That’s about 2% of our $30 trillion economy. “It’s meaningful,” says Schuster, “but it’s important to remember that it’s still a small part of a very large and diversified American economy.”

Though there is now more clarity about what tariffs will be implemented, unanswered questions remain about what comes next. “This poses important questions given the lack of clarity around who pays for the tariffs and how long they might last,” says Mike Scarsciotti of Fidelity’s Capital Markets Strategy Group. He says the tariffs could slow US GDP by 0.55%. That would not, by itself, tip the US economy into recession but could slow growth to between 0% and 1%.

The wide-ranging nature of the tariffs means they are also likely to cause higher inflation. "A transitory period of inflation due to tariffs could be drawn out, especially if they are rolled out gradually. If companies and consumers delay spending in this environment, there could be a deeper impact on growth,” he says.

Tariffs and markets

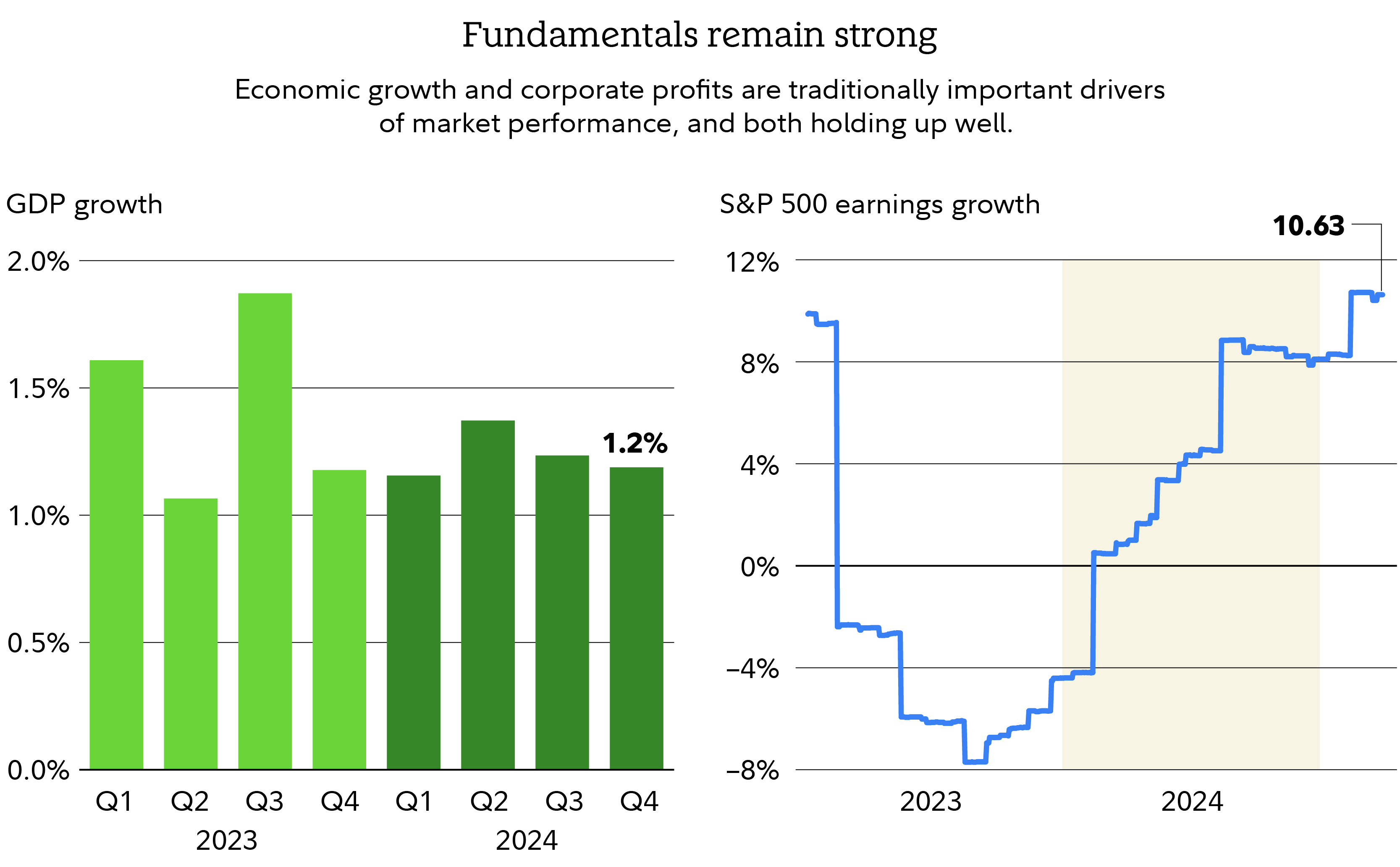

It's important to remember that economic growth and corporate profits have historically been far more important for financial market performance than shifts in government policy and these have remained positive despite anxiety-producing rhetoric and headlines.

Sources: US Bureau of Economic Analysis, Gross Domestic Product, retrieved from FRED, Federal Reserve Bank of St. Louis; S&P 500 earnings growth, FactSet.

“Markets appear to be pricing in weaker growth, warmer inflation, a weaker US dollar, and an increased likelihood that the Fed will cut interest rates later in 2025," says Schuster.

Though market volatility may remain in the short term, Scarsciotti believes stocks and bonds have the potential to deliver positive returns over the long term thanks to continued economic and earnings growth. “Our outlook for US stocks remains positive and we believe intermediate-term bonds can offer yield as well as diversification,” says Scarsciotti. Schuster agrees, saying he sees “bonds playing their traditional role by acting as portfolio shock absorbers.”

What investors can do

Of course it's only natural to be concerned when the market experiences fluctuation. It's important to take a long-term view of an investor's investments and review them regularly to make sure they line up with the investors' time frame for investing, risk tolerance, and financial situation. Ideally, an investor's investment mix is one that offers the potential to meet their goals while also letting them rest easy at night.

We suggest investors define their goals and time frame, take stock of their tolerance for risk, and choose a diversified mix of stocks, bonds, and short-term investments that they consider appropriate for their investing goals.

Schuster says the Strategic Advisers investment team relies on broad diversification across a wide range of asset classes to help manage potential risks including international stocks and inflation hedges.

Scarsciotti notes that diversification within and between asset classes can help manage risk and protect against inflation. “Within your stock portfolio, you could consider a balance between value-oriented dividend-yielding stocks as well as growth, and international stocks as well as US-listed ones. Also, evaluate how much you're holding in cash and consider locking in higher yields on intermediate-term bonds if it makes sense for your plan,” he says.

“Staying invested is hard at times like these,” says Schuster. “But remember, the market often comes back fast and unexpectedly. The biggest mistake investors often make is trying to time the market and then not being there for the recovery.”

Next steps to consider

Asset Allocation Research Team (AART)

Access economic, fundamental, and quantitative analysis from our Asset Allocation Research Team.

Learn more

Investment & Retirement Products

Meet the unique financial needs of your clients with our diverse investment and retirement offerings.

Learn more

Money Market Funds Resource Center

Browse through powerful insights and resources from one of the largest money market mutual fund providers in the industry.

Learn more

Past performance is no guarantee of future results.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Investment decisions should be based on an individual's own goals, time horizon, and tolerance for risk.

Indexes are unmanaged. It is not possible to invest directly in an index.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

S&P 500 Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance.

Fidelity Investments® provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC; and institutional advisory services through Fidelity Institutional Wealth Adviser LLC.