What's ahead for stocks in 2025

2024 was a "Goldilocks" year. Could it happen again?

- Stocks delivered exceptionally strong returns in 2024 due to a rare "Goldilocks" combination of strong earnings growth plus rising price-earnings ratios.

- 2025 may be less likely to see a repeat of this combination. Instead, stock gains may be more likely to track earnings growth (which continues to look robust).

- One key risk to watch for in the year ahead may be a reacceleration in inflation, which could occur if the economy reaccelerates.

As the sun sets on 2024, let’s review how we got here and where the markets may take us in 2025. Personally, I am bullish on stocks for 2025, though with valuations high and the bull market maturing, I don’t think investors should expect quite such spectacular returns next year as we have seen this past year. And I think there are important risks from inflation, and the market’s concentration, to be aware of.

2024 in review: A "Goldilocks" year for US stock returns

While 2023 was a year of frustration, as many missed the 26% rally, 2024 was one of ebullience and momentum—at least toward the end. The market set new all-time highs in January, which turned out to be a bullish omen that the market would gain momentum. From there, the S&P 500® Index went up in an almost straight line, with the exceptions of a brief 5% decline in the spring (on interest-rate worries), and a 10% decline in the summer (on economic-growth worries).

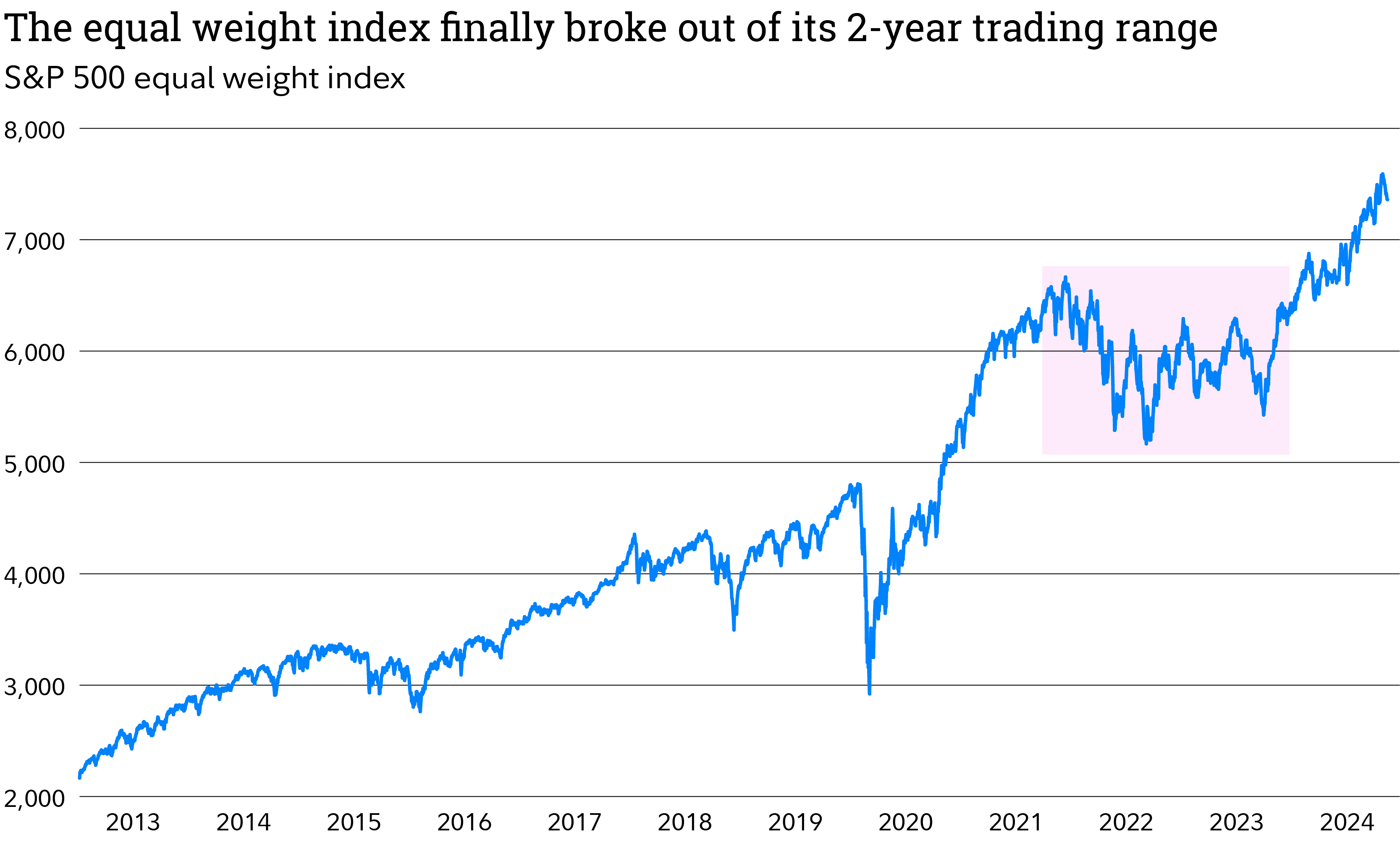

As of mid-December, the year looks poised to end with a bang, with the major stock market averages recently at or near their all-time highs. As of last week, the flagship capitalization-weighted S&P 500® Index was up 28%. And the equal-weighted S&P 500 (in which every company receives the same weighting—diminishing the impact of mega-cap companies) was up 17%, after finally breaking out of its 2-year trading range and making new all-time highs in the year.

Past performance is no guarantee of future results. The S&P 500 Equal Weight Index is the equal-weight version of the S&P 500. It includes the same constituents as the capitalization-weighted S&P 500, but each company is allocated a fixed weight, or 0.2% of the index total at each quarterly rebalance. Data as of December 16, 2024. Sources: FMRCo., Bloomberg, Haver Analytics.

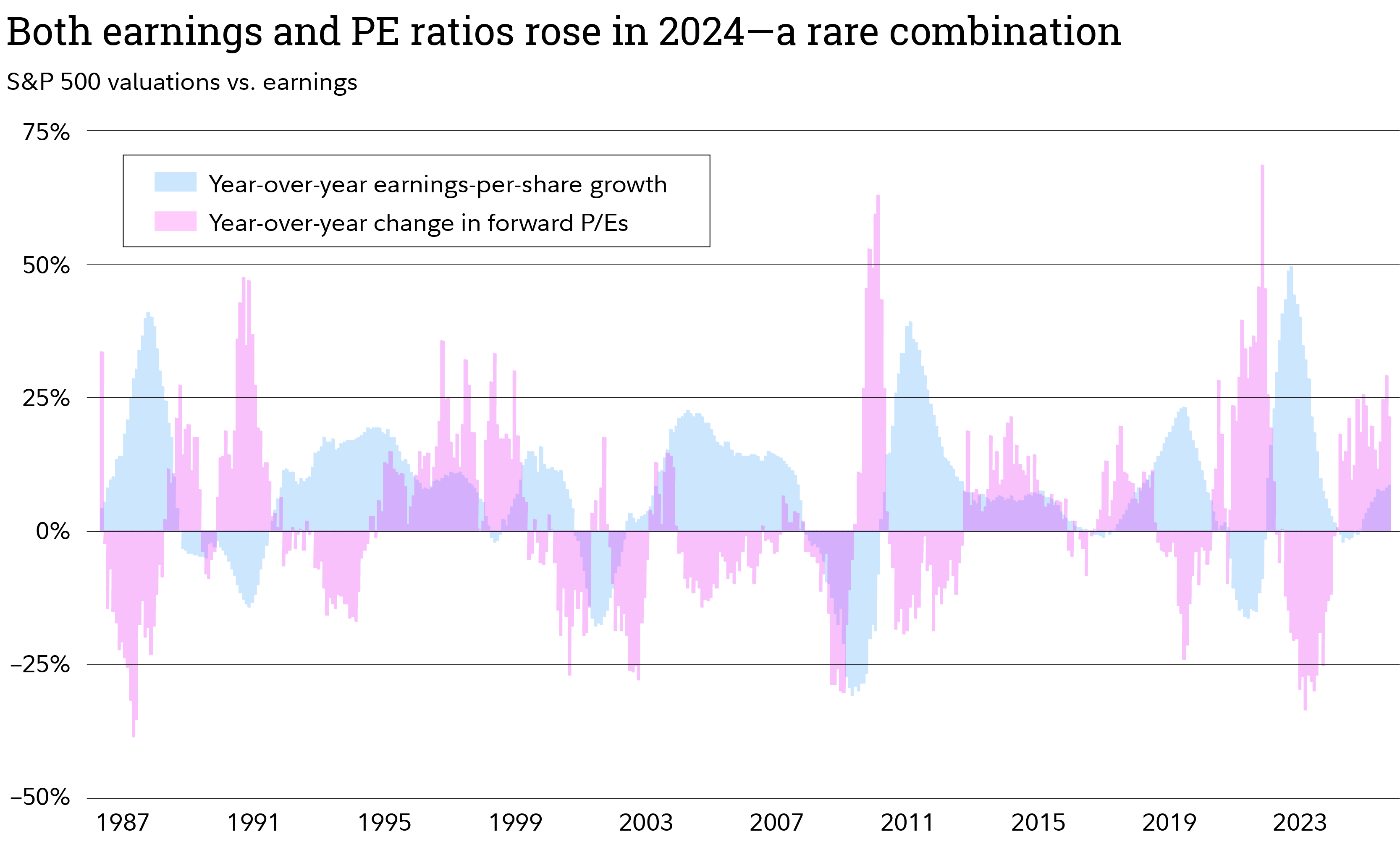

Looking back at my outlook from a year ago, I got the direction of stocks right, but I wasn’t nearly bullish enough. My view a year ago was that 2024 would produce an earnings-led rally, with stocks roughly rising in line with rising earnings. I incorrectly concluded that after a significant rise in PE ratios over 2023, they wouldn’t have much further to rise, and that further gains would have to come from earnings growth.

Instead, PE ratios and other measures of valuation continued to expand (at least for the mega-growers), greatly amplifying what turned out to be a year of robust earnings growth. That’s a rare combination of outcomes, usually only produced during soft landing “Goldilocks” regimes, which is what we got in 2024.

Past performance is no guarantee of future results. Based on data for S&P 500 constituent companies. Forward P/E is stock price divided by consensus earnings estimates for the following 12 months. Data as of December 16, 2024. Sources: FMRCo., Haver Analytics, Factset.

2025 outlook: More modest gains ahead?

I remain bullish on stocks for 2025. The earnings picture looks robust going into 2025, based on S&P 500 consensus expected earnings. Earnings expectations for the mega-cap growers, such as the “Magnificent 7” group of stocks, look even better, and have continued to show impressive acceleration.

However, after the rise in PE ratios in each of the past 2 calendar years, valuations are now looking stretched (recently in their 90th percentile). That’s why I think it may be a challenge for stocks to repeat the robust performance of 2023 and 2024. It would take the market into bubble mode if PE ratios were to expand significantly for a 3rd year in a row.

Instead, earnings will truly have to carry the day in 2025, and I think they will. But with this bull market now in its third year—after starting in October 2022—we are in later innings. And although the market has had significant momentum recently, it could get interrupted as the Fed nears the end (or at least a pause) in rate cuts.

The mega-cap growers vs. everything else

One of the big stories of this bull market cycle has been the market’s narrowness, meaning how concentrated gains have been among just a handful of mega-cap stocks (i.e., the Mag 7). We did finally see the market begin to broaden this past year, in that a rising percentage of stocks participated in the bull market, while the market itself continued to rally.

But in relative terms the market is only marginally broader than it was in 2023, with 41% of stocks outperforming the index instead of 26% in 2023. Judging by the runaway train that is the Mag 7, the market “feels” as narrow as it did last year, even though it isn’t. This narrowness is also reflected in the concentration of the US stock market. The more the Mag 7 gain, the greater they grow in terms of market capitalization. As long as they continue to outperform, the greater they also grow as a percent of indexes like the S&P and as a percent of the entire US market.

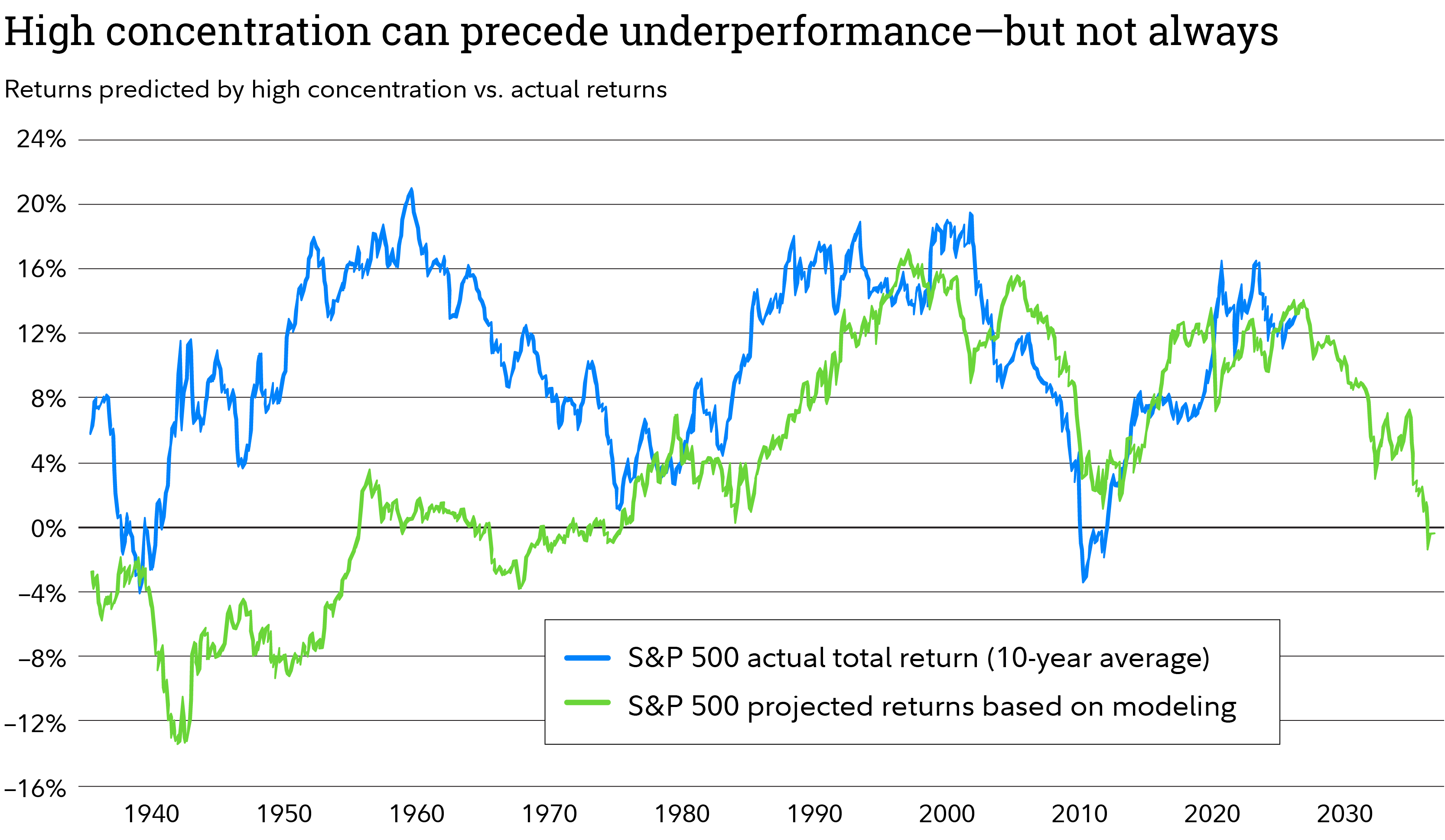

A popular narrative making the rounds on Wall Street in recent weeks is that this concentration could lead to a long winter of below-average returns. Much like the cyclically adjusted PE model (which holds that high PEs tend to precede lower 10-year subsequent returns), this narrative posits that a high concentration can diminish future returns.

While this relationship can be true (and looks true when one considers how the dot-com bubble of the late 1990s ended), it hasn’t always been. This theory counts on mean reversion—the idea that a period of high concentration must end in a timely manner. But periods of top-heavy concentration can last for decades, as was the case during the 1950s and 1960s. Take the math back even further and it’s clear this relationship has been far from consistent.

Past performance is no guarantee of future results. Projected returns are based on a regression model using the market’s concentration in the 50 largest companies as an independent variable and the subsequent 10-year compounded annual growth rate as a dependent variable. Monthly data since 1926. Sources: FMRCo. Technical Research, Bloomberg, Haver Analytics, Factset.

Highly concentrated markets can end with below-average results, but they don’t necessarily have to.

Risks for 2025: Reversing momentum, inflation

While it’s not my base case, one risk I see for 2025 is that the Mag 7 momentum reverses and takes the market down with it (which it would do given its weight).

That would take us from a bullish broadening to a disorderly broadening, in which the left-behind parts of the stock market (such as small caps and international) could outperform, but in a falling market.

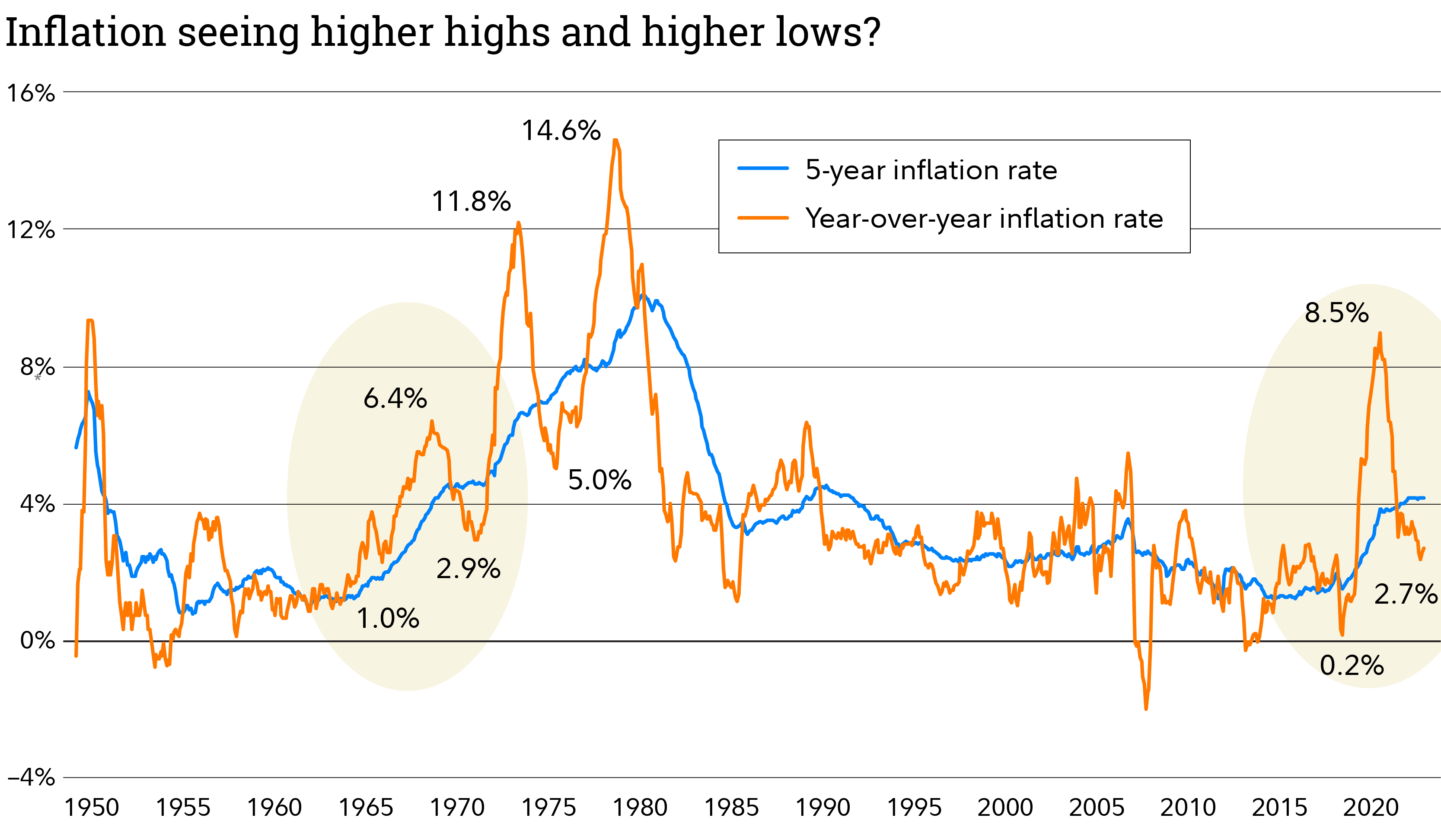

The other biggest potential risk comes from inflation, the Fed, and bond yields. While I don’t expect a repeat of the inflation of the 1970s, the chart below gives me pause. During the second half of the 1960s there was an inflation wave, and when that ended the year-over-year inflation rate made a higher low (2.9% compared with 1.0%). From there, another wave happened, and another, each making a higher high and a higher low for inflation.

Inflation rate represented by the Consumer Price Index, which measures the average change in price over time of a market basket of goods and services for urban consumers. Monthly data as of December 16, 2024. Sources: FMRCo., Bloomberg, Haver Analytics.

Again, it’s not my baseline case, but we can see some similarities to those trends today. Now that the initial COVID-induced wave of inflation has subsided, the inflation rate has made a higher low of 2.7% (compared with 0.2%) and has been bouncing around that level. What if the economy accelerates in 2025, and the inflation rate advances again? That could lead to higher interest rates, which might be an unwelcome surprise for the stock market.

Whatever happens, 2025 is sure to bring many fresh challenges and opportunities to unpack and analyze!

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Investing involves risk, including risk of loss.

Past performance and dividend rates are historical and do not guarantee future results.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

The S&P 500® Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance.

Indexes are unmanaged. It is not possible to invest directly in an index.

Fidelity Investments® provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC; and institutional advisory services through Fidelity Institutional Wealth Adviser LLC.