|

|

There was an issue with your input |

Advanced Modeling & Rebalancing

A flexible portfolio construction and management tool that helps support your firm's distinct investment strategies

Advanced Modeling & Rebalancing

A flexible portfolio construction and management tool that helps support your firm's distinct investment strategies.

Key Functionality

Builds on our core solution, facilitating a more efficient approach to portfolio management

Core Functionality

Modeling

- Individual Security Modeling

- Composite Modeling

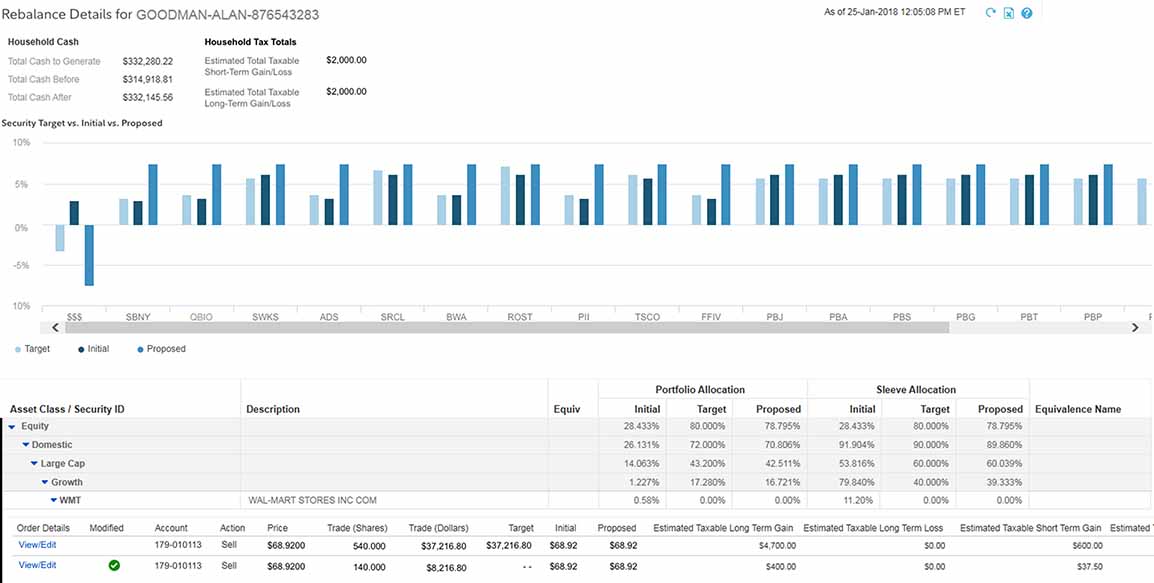

- Drift Reporting

- Access to Fidelity Models

Scale & Accuracy

- Real-time pricing

- Custom trade minimums and thresholds

- Intraday positions and balances

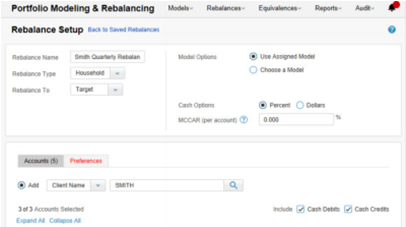

Rebalancing

- Account, client, or group Rebalancing

- Account Rebalancing

- Rebalance Fidelity Workplace Accounts

Screenshots are for illustrative purposes only.

- The tax information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice. Fidelity does not provide legal or tax advice. Laws of a particular state or laws that may be applicable to a particular situation may have an impact on the applicability, accuracy, or completeness of such information. Consult an attorney or tax professional regarding your specific legal or tax situation.